pay utah state sales tax online

Filing Paying Your Taxes This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Local tax rates can include a local option up to 1.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Additionally the state has excise and special taxes for.

. Monthly quarterly and annual sales tax returns. Utahs sales tax rate is 485 percent of retail goods and some services sold. Questions about your property tax bill and payments are handled by your local county officials.

On that confirmation page above note that you can either select Pay Online or Paper Check for. Follow the instructions at taputahgov. Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission.

The state sales tax in Utah UT is 47 percent. Sales and use tax rates vary. INDIVIDUAL INCOME TAXES BUSINESS CORPORATE TAXES SALES USE TAXES WITHHOLDING TAXES.

Sales Related Tax and Schedule Information. Sales tax requires merchants pay sales tax of some kind in states. 465 rows A convenience fee is charged when you pay your taxes using a credit card.

See Payment Alternatives for more. Please contact us at 801-297-2200 or taxmasterutahgov for more information. In the state of Utah sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Multiply the rate by the purchase price to calculate the sales tax amount. Every business with a combined sales and use tax liability of 96000 or more for the preceding calendar year must pay sales tax monthly by electronic funds transfer EFT. The total tax rate might be as high as 87 depending on local jurisdictions.

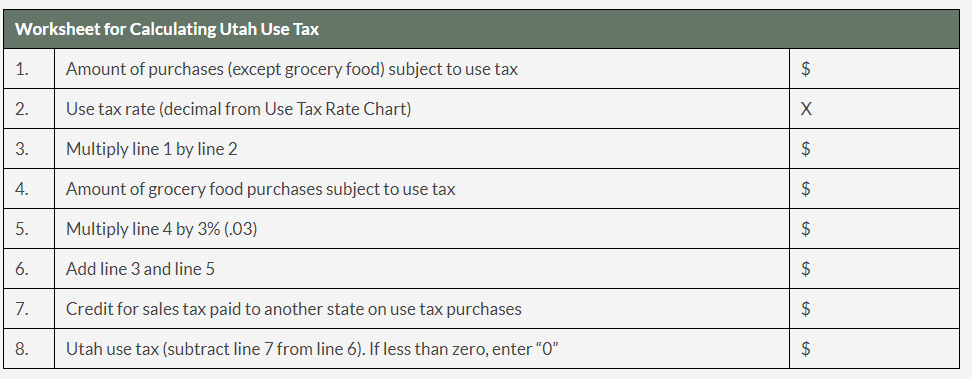

Taxpayer Access Point Utahs Tax Portal File pay manage your Utah taxes online. You can also pay online and. Add lines 8 on all worksheets and enter the total on line 31.

Utah Sales Tax Guide for Businesses Statewide sales tax rate 61 Economic Sales Threshold 100000 Transactions Threshold 200 Website State Tax Commission Tax Line 800-662-4335. You can also pay online and. How To Pay Utah State Taxes Online.

Please visit this page to contact your county officials. Local jurisdictions also have a sales and use tax rate. See Utah Sales Use Tax Rates to find your local sales tax rate.

How to Pay Utahs Sales Tax You are now ready to make your payment. This section discusses information regarding paying your Utah income taxes. Any seller with an annual sales and use tax liability of 50000 or more must file and pay sales and use tax monthly.

The return and payment are due by the last day of the month following. Note that sales tax due may be adjusted and payment. No convenience fee is charged when you pay with an e-check.

Online payments may include a service fee. If you paid sales tax to more than one state complete the Use Tax Worksheet below for each state. Modern retail sales tax is generally considered to date back to 1930 and is managed at a state level.

If you are mailing a check or money order please write in your account number and filing period or use a. Some examples of items that are exempt from Utah sales. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Examples Self Review Photography Utah State Tax

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

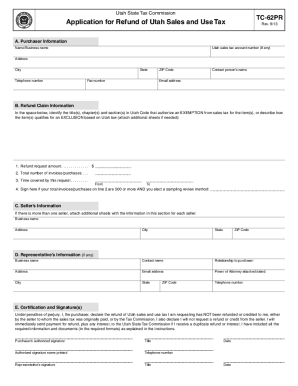

Sales Tax Refund Request Utah State Tax Commission Form Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In Utah Taxvalet

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Fillable Online Tax Utah Cover Letter For Tax Commission Form Fax Email Print Pdffiller

Free Utah Bill Of Sale Forms 4 Pdf Eforms

Learn More From Our Online Sales Tax Guide For Ecommerce

Do You Pay Sales Tax On Your Online Holiday Shopping Tax Policy Center

Business Guide To Sales Tax In Utah

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Online Sales Tax In 2022 For Ecommerce Businesses By State

Arizona State Tax Commission 1 Sales Tax Payment Ebay

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities